Our Partners

Kasisto partners with some of the world’s leading FinTech companies to transform the way customers, members, and employees engage with and experience financial services.

Dive into conversational AI-driven banking with our insightful collection of reports, case studies, product sheets, and more.

By Keelan Evanini, Senior Vice President of Engineering and AI at Kasisto We have all read a lot about the…

Read our comprehensive industry reports and whitepapers to gain valuable takeaways and stay up to date with the latest trends and developments in finance.

Continuous learning delivers on the promise of Conversational AI for the Financial Services Industry.

Learn why conversational AI in financial services gives a competitive advantage; the pros and cons of generic versus market-specific solutions; and why firms are better off deploying tools meant specifically for them.

In this paper, we explore how intelligent digital assistants, powered by conversational AI, can underpin a banking experience of the future; one that can drive loyalty and personalization and garner efficiencies, while at the same time becoming a critical enabler for the next generation of cognitive banking customer engagement.

Chatbots and intelligent digital assistants have come a long way in banking in just a few short years (actually, they were the longest years of our lives).

Today, financial institutions face greater competition than ever as consumers demand more convenient, frictionless service and personalized experiences. With this ongoing industry shift, Chief Marketing Officers must find a way to differentiate their brand and stand out among the sea of options.

Discover how our AI-powered solutions have transformed leading financial institutions’ business operations and customer experiences through real-world case studies.

How Gabby Helped First Financial Bank Grow Accounts and Retain Customers – This case study will explore how the bank successfully introduced a KAI-powered intelligent digital assistant (IDA) and stayed true to its mission of offering personalized service across all of its customers’ financial needs to make sure they get everything they deserve.

Meriwest, was faced with the challenges of traditional customer service methods that were impacting operational efficiency and member satisfaction. Realizing the untapped possibilities among their digital banking customers, they were determined to find a groundbreaking solution. Meet Scout, their KAI-powered digital assistant. Scout not only surpassed the capabilities of a typical chatbot but became an…

Creating a Digital Experience that Meets Modern Expectations – Read how VeraBank successfully launched a KAI-powered intelligent digital assistant to better serve their customers, achieve significant benefits while addressing operational challenges.

Read the full case study to learn about Standard Chartered Bank’s selection process, why Kasisto’s KAI was the chosen solution, and the business opportunities uncovered while optimizing operational costs.

Get detailed information about our conversational and generative AI products with product sheets that outline key features, benefits, and use cases to help you make informed decisions.

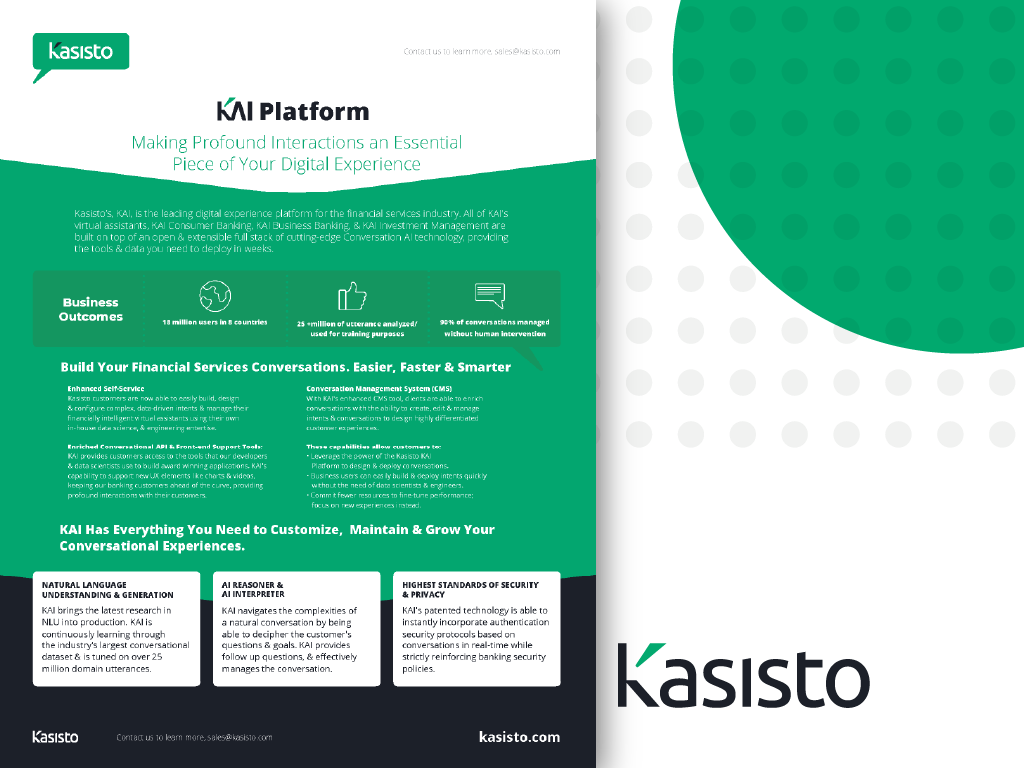

Learn about KAI 4.0, the leading-edge Conversational AI technology that allows you to create profound interactions.

Learn more about KIM, our investment management conversational AI solution.

Learn more about KBB, our business banking conversational AI solution.

Learn more about KCB, our consumer banking conversational AI solution.

Understand how artificial intelligence powers digital experiences in banking by reviewing engaging infographics.

Digital engagement is no longer defined by what capabilities your website or mobile app offer, but rather how intelligent, conversational, and engaging your digital offerings need to be.

Let’s dive deeper into what an intelligent digital assistant offers and why it stands above the rest.

Our proven Ready, Set, Go! implementation process focuses on understanding your brand, your people, your products, and the communities you serve. This helps us successfully launch and rapidly adopt an intelligent digital assistant custom-tailored to your financial institution.

Explore a library of videos and podcast episodes that offer expert perspectives, thought leadership, and deep dives into the latest trends, technologies, and challenges shaping the financial industry.

Chatbots do not offer these capabilities. KAI-powered virtual assistants have these and more. KAI has what it takes on day one. KAI is trained and ready to host the humanizing experiences today’s customers demand, while intuitively opening doors to deeper customer engagements.

Meet KAI, our digital experience platform. KAI is proven to deliver digital experiences that surprise and delight millions of banking customers around the world. Based on industry leading Conversational AI technology, KAI and its virtual assistants help to automate and augment conversational interactions, across any channel, all the time, driving contextual, insightful, and personalized conversations…

Kasisto partners with some of the world’s leading FinTech companies to transform the way customers, members, and employees engage with and experience financial services.